Understanding Your Financial Needs Exercises

These exercises build upon assumptions put forth in Doug McCormick’s Family Inc.: Using Business Principles to Maximize Your Family’s Wealth.

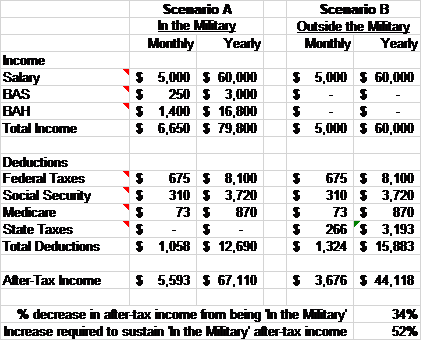

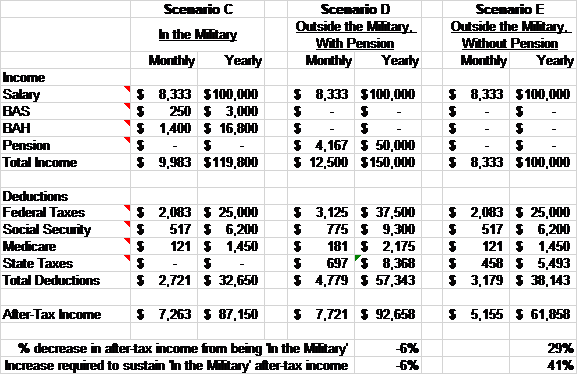

Required Annual Salary Third Exercise: Compare

Military and Civilian Benefits

The first step in understanding your financial needs is to determine what your cash flow needs will be in retirement. Because JMPs (and some CMPs) won’t be drawing a military pension, we will consider two scenarios. Let’s make a few assumptions and back into a figure. For the sake of discussion, let’s define retirement as when you would cease drawing any sort of salary and becoming entirely reliant upon your savings and pension (if you have one) for income. Let’s assume that age to be 65, although others would suggest 67 or older to optimize social security payments and delay withdrawals from your accumulated savings. Let’s assume you will live to the ripe old age of 90 and will want to maintain – not exhaust - the amount of your accumulated nest egg. For our analysis, we will assume that means the amount of savings at age 90 should roughly equal the amount of savings at our retirement age of 65, ignoring inflation. Let’s further assume, conservatively, the following:

- You will withdraw 4% of your savings every year in retirement

- Those savings will be subject to annual investment fees of 0.25% and will realize an annual 5% return

- The Federal tax rate in your retirement years will be 25%, which reflects a married, filing jointly status

- Your assumed Virginia residency carries with it a state income tax of $720 plus 5.75% of any income over $17,000

- Social Security taxes are 6.2% of gross income; Medicare taxes are 1.45% of gross income

- You will realize monthly social security payment of $2000; your spouse will realize $1500 monthly payments – both without an annual Cost of Living Adjustment (COLA)

- A Retiree’s annual pension is 50% of $100,000 with no COLA, based on a military retirement at 20 years

- Expenses will be $100,000 annually and subject to 2% inflation

- Any annual surplus (or deficit) will be added to (or taken from) Savings

Table 1 summarizes this list. You should update these assumptions with more accurate details from your own personal scenario. You can do so by using the downloadable Retirement Worksheets here:

| Assumption | JMP scenario | Retiree scenario |

| Life expectancy | 90 years old | 90 years old |

| Retirement age | 65 years old | 65 years old |

| Annual retirement savings withdrawal rate | 4% | 4% |

| Annual investment fees | 0.25% | 0.25% |

| Federal Tax rate in retirement | 25% | 25% |

| Marital status | Married | Married |

| Residency | Virginia | Virginia |

| Annual Social security amount at 65 | $42,000 | $42,000 |

| Annual Military Pension | N/A | $50,000 |

| Annual expenses | $100,000 | $100,000 |

| Annual inflation rate | 2% | 2% |

| Annual return on investments | 5% | 5% |

Table 1. Retirement Savings Requirement Assumptions

Based on these assumptions, here is your bottom line up front (BLUF):

A retired career military professional should aim to have at least $1,655,512 in savings by the time they would retire at age 65.

A JMP (and non-retired CMPs) should aim to have at least $2,688,165 in savings by the time they would retire at age 65. The lack of a pension in departing the service has a big impact on the additional savings you’ll need to accumulate to meet the same goals in retirement.

Those are admittedly big figures because this is an admittedly conservative analysis. Some ways in which you can positively influence these figures (meaning, needing a smaller amount at age 65) - by either saving more or cutting costs between the time you leave the service and your retirement at 65 - include:

- Delaying retirement until age 67 or 70 or later

- For CMPs, staying in the service longer to maximize the pension percentage for which you are eligible

- For JMPs and non-retired CMPs, considering additional time in the Reserves or the Guard (Army and Air Force only) to eventually qualify for a pension. See ‘Advice for Professionals Transitioning into the Guard or Reserve’ .

- Optimizing your and your spouse’s incomes prior to retirement to optimize your Social Security payments in retirement and to optimize the incremental amount you can contribute to savings on an annual basis

- Retiring to a state that provides more favorable tax treatment to retirement income and military pensions WalletHub produces an annual ranking of best and worst states for military retirees. Here is their 2017 ranking: https://wallethub.com/edu/best-states-for-military-retirees/3915/

- Maximizing your employer-sponsored 401k or 403b (or, better yet, Roth 401k or Roth 403b) investments every year while employed following your departure from the service. (Limits vary annually; currently they are $23,500/year; and those 50 years old or older can contribute an additional $7500 for a total of $31,000.) This both minimizes your taxable income and adds to your retirement savings by qualifying for your employer’s match.

- If applicable, take advantage of an employer-sponsored 457 savings plan (Limits vary annually; currently they are $23,500/year.)

- Rolling over your Thrift Savings Plan from the military into a Roth IRA and/or invest any incremental net income into a Roth IRA. This will minimize your tax burden in retirement.

- Make annual contributions to an IRA or Roth IRA. (Limits vary annually; currently they are $7000/year; and those 50 years old or older can contribute an additional $1000 for a total of $8000.) This might be a good idea for any annual surplus you realize.

- Minimizing your annual expenses both before and after retirement

- Minimizing fees that any brokerage firm would charge on your investments

Required Annual Salary

Military and Civilian Benefits

See: Doug McCormick, Family Inc.: Using Business Principles to Maximize Your Family’s Wealth, (Hoboken, NJ: Wiley Publishing Inc., 2016).

“1040 2016 Tax Tables,” Department of the Treasury Internal Revenue Service, accessed May 19, 2017, https://www.irs.gov/pub/irs-pdf/i1040tt.pdf.

“1040 2016 Tax Tables,” Department of the Treasury Internal Revenue Service, accessed May 19, 2017, https://www.irs.gov/pub/irs-pdf/i1040tt.pdf.

“Military Compensation, Retirement,” Department of Defense, accessed May 19, 2017, http://militarypay.defense.gov/Pay/Retirement.aspx.

“State/Territory Benefits,” MyArmyBenefits, accessed November 1, 2017, http://myarmybenefits.us.army.mil/Home/Benefit_Library/State__Territory_Benefits.html.

“1040 2016 Tax Tables,” Department of the Treasury Internal Revenue Service, accessed May 19, 2017, https://www.irs.gov/pub/irs-pdf/i1040tt.pdf.

“How Virginia Tax is Calculated,” Virginia Individual Income Tax, accessed May 19, 2017, https://tax.virginia.gov/income-tax-calculator.

“Military Compensation, Retirement,” Department of Defense, accessed May 19, 2017, http://militarypay.defense.gov/Pay/Retirement.aspx.

Derek B. Stewart and James R. White, “Active Duty Military Compensation and Its Tax Treatment,” U.S. General Accounting Office, May 7, 2004, accessed November 1, 2017, http://www.gao.gov/assets/100/92588.pdf.

“Monthly Basic Pay Table Effective 1 January 2017,” Department of Defense, accessed November 1, 2017,http://militarypay.defense.gov/Portals/3/Documents/ActiveDutyTables/BasicPayTable2017.pdf?ver=2017-04-24-231808-783.

“Military Compensation, Basic Allowance for Subsistence (BAS),” Department of Defense, accessed November 1, 2017, http://militarypay.defense.gov/Pay/Allowances/BAS.aspx.

“BAH Calculator,” Defense Travel Management Office, accessed November 1, 2017, https://www.defensetravel.dod.mil/site/bahCalc.cfm.

“1040 2016 Tax Tables,” Department of the Treasury Internal Revenue Service, accessed May 19, 2017, https://www.irs.gov/pub/irs-pdf/i1040tt.pdf.

“How Virginia Tax is Calculated,” Virginia Individual Income Tax, accessed May 19, 2017, https://tax.virginia.gov/income-tax-calculator.

“Monthly Basic Pay Table Effective 1 January 2017,” Department of Defense, accessed November 1, 2017,http://militarypay.defense.gov/Portals/3/Documents/ActiveDutyTables/BasicPayTable2017.pdf?ver=2017-04-24-231808-783.

“BAH Calculator,” Defense Travel Management Office, accessed November 1, 2017, https://www.defensetravel.dod.mil/site/bahCalc.cfm.

“Military Compensation,” Department of Defense, accessed March 1, 2019, http://militarypay.defense.gov/.

“State/Territory Benefits,” MyArmyBenefits, accessed November 1, 2017, http://myarmybenefits.us.army.mil/Home/Benefit_Library/State__Territory_Benefits.html.

“Military: Active Duty and Veterans,” Benefits.gov, accessed November 1, 2017, https://www.benefits.gov/benefits/browse-by-category/category/30.

“Federal Benefits,” MyArmyBenefits, accessed November 1, 2017, http://myarmybenefits.us.army.mil/Home/Benefit_Library/Federal_Benefits_Page.html.

See also: Rod Powers, Veterans Benefits for Dummies, (Indianapolis, IN: Wiley Publishing Inc., 2009).

See also: Ronald L. Krannich, Ph.D., Military-to-Civilian: Success for Veterans and Their Families (Manassas Park, VA: Impact Publications, 2016).